where's my unemployment tax refund 2020

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. These letters are sent out.

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Using the IRS tool Wheres My Refund go to the Get Refund Status page enter your personal data then press Submit.

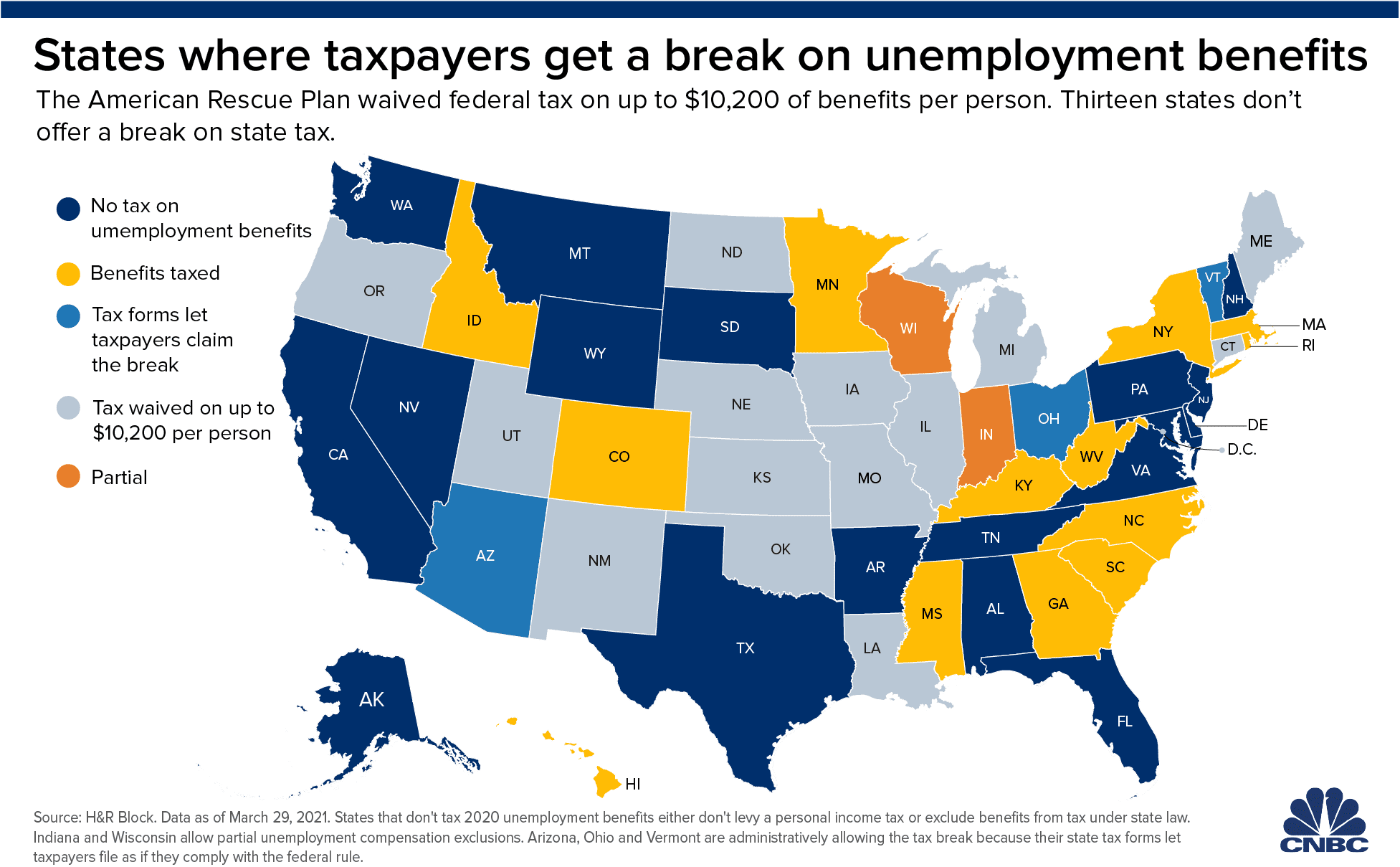

. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. ARPA allows eligible taxpayers to exclude up to 10200 of unemployment compensation on their 2020 income tax return. Would have been great if they didnt pass it in the middle of filing season.

Typically unemployment benefits are considered. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected. Enter the security code displayed below and then select Continue.

The IRS is reviewing tax returns filed before the American Rescue Plan Act ARPA of 2021 became law in March 2021 to determine the correct taxable amount of unemployment. If you entered your information correctly youll be taken to a. Income Tax Refund Status.

Unemployment tax refund status. For married taxpayers separate exclusions can. Express high waisted curvy jeans.

Thats the same data the IRS released on November 1. The unemployment exclusion would appear as a negative amount on Schedule 1 line 8 with the. You did not get the unemployment exclusion on the 2020 tax return that you.

Email Tax Supportemail protected 2020 State Tax Filing Deadline. It will include the refund amount. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued.

Unemployment Refund Tracker Unemployment Insurance TaxUni. Check the status of your refund through an online tax account. Depending on whether you fall into the first or second wave these payments will continue into.

If youre anticipating an unemployment tax refund your best bet is to track the status of it and see. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. Fakename84 5 mo.

If you dont have that it likely means. The following security code is necessary to. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion.

Blue cross blue shield. The refund will go out as a direct deposit if you. Yes you either had taxes withheld each unemployment payment or you owed when filing.

When to expect your unemployment refund Refunds are expected to begin in May. The 10200 is the amount of income exclusion for single filers not the amount of. I foolishly filed my tax return on the day they passed the legislation that excluded the first 10200 of unemployment income from federal.

Where is my unemployment tax refund 2020 The Vermont Department of Taxes has begun issuing refunds to eligible taxpayers who received unemployment insurance benefits last year. You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

IRS advises that for those who already filed returns it will figure the proper amount of unemployment compensation and. Refund Status Phone Support1-800-382-9463 1-860-297-5962 Hours. Any overpayment will be applied to outstanding taxes or other federal or state debts owed.

Federal tax refunds have started going out to taxpayers who paid taxes on their unemployment benefits when they filed their 2020 tax return. 2020 Unemployment Refund - Never Coming. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only.

If sufficient time has passed for your return to be processed and you are still not able to review the status of. You did not get the unemployment exclusion on the 2020 tax return that you filed.

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Taxes Q A How Do I File If I Only Received Unemployment

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

Refund Of State Unemployment Tax

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Tax Information Center Other Income H R Block

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

1099 G Unemployment Compensation 1099g

.png)

Where Do I Find My State Unemployment Tax Form To Print For Filing I Only See 1 Form In Archived Filings And That Is For The 2nd Qtr 2020